EXPLORATION

AND DEVELOPMENT OF THE SEPON GOLD AND COPPER DEPOSITS, LAOS.

Tony

Manini and Peter Albert,

Oxiana Limited, Level 9, 31

Queen Street, Melbourne, Victoria 3000.

Key

Words: copper, exploration, feasibility study, gold, Laos, mine

Introduction

The Sepon project comprises

a 1947 square kilometre contract area located approximately 40 kilometers north

of the town of Sepon, in Savannakhet province of south-central Laos (Figure 1).

Gold and copper deposits

discovered in the Sepon district by CRA/RioTinto (1993-1999) and Oxiana

(2000-2003) contain over four million ounces of gold and 1.2 million tonnes of

contained copper. Seven gold and one copper deposit occur in separate adjacent

deposits over five kilometers.

Gold

mineralisation occurs as fine disseminations in highly altered calcareous

sedimentary rocks with many affinities to the Carlin style gold deposits of

Nevada, USA. The Khanong copper deposit is a near surface high grade supergene

chalcocite and oxide copper body derived from the weathering of a replacement

style massive sulphide deposit developed in shallow dipping, highly sheared

carbonate rocks.

Oxiana acquired an 80% stake

in the project in early 2000 with the vendor Rio Tinto retaining a 20%

shareholding. Upon finalisation of the asset sale in August 2000 Oxiana

immediately commenced feasibility and environmental - social impact studies for

a two stage development of the Sepon gold and copper projects.

Following a 12 months

construction period, the 1.25 mtpa Sepon gold mine poured first gold in late

December 2002 and has now been operating successfully for more than nine

months. Extensive exploration and development drilling in 2003 has

significantly upgraded the gold resource and reserve base to 14.2Mt @ 3.43g/t

Au (70% increase in reserve ounces) and a study to expand the gold project has

been initiated.

Copper Project feasibility

and environmental - social impact studies were completed over 10 months in 2002

including pilot plant test work at Lakefield Research in Canada. The project is

designed to produce 60,000 tpa of LME grade copper cathode.

In January 2003 engineering

and construction of the Copper Project was awarded to a joint venture between

Bateman Limited and Ausenco Limited and after 9 months of a 27 months program

the project is on schedule to produce first copper in March 2005.

New discoveries continue to

be made and exploration for both gold and copper is

ongoing with many targets remaining to be assessed. Aggressive year

round drilling campaigns continue to expand both the resource and reserve bases

and test the pipeline of new gold and copper targets being generated.

Oxiana is focused on

maximizing its investment in the Sepon project through continuous exploration

and incremental expansion of its gold and copper mining operations over time.

The ultimate production potential of the Sepon District is considered to be

significantly greater than its current scale.

Figure 1. Location of the Sepon Project

Project History

Although numerous river

valleys of the Sepon district have long been the subject of sporadic artisanal

gold panning, no assessment of the hard rock potential had ever been undertaken

prior to the involvement of CRA Exploration in 1990.

Potential of the Sepon

district was first recognised by CRA geologists during follow up of UNDP

(United Nations Development Program) mineral occurrence data and information

sourced from archives in the Laos Department of Geology and Mines. While the

style of mineralisation was not immediately discernable, the association of

porphyry intrusives, district scale alteration and extensive gold occurrences

(alluvial and hardrock) was considered highly significant. When the assay

results for 18 rock samples reported between 3.6 and 55.9g/tAu prospectivity

was confirmed.

An application covering 5000

square kilometers in Savannakhet and Khammouane Provinces was submitted to the

Lao Government in early 1991. Following two years of pioneering negotiations, a

Mineral Exploration and Production Agreement (MEPA) similar to the Indonesian

Contract of Work was signed in September 1993. This Agreement provides for the

exclusive right to explore, mine, process, transport and market all minerals

from the MEPA area and clearly defines the life of project commercial and fiscal

framework.

Intensive exploration by

CRA/RioTinto between 1993 and 1999 resulted in the discovery of around 3 Moz of

gold and an estimated 0.9 Mt of contained copper in six separate deposits.

In 1999 Rio Tinto decided to

divest of the Sepon Project because it did not satisfy the companies resource

size criteria. The project was put to competitive tender and following

extensive due diligence Oxiana successfully bid for an 80% stake in the project

in early 2000. Rio Tinto retained a 20% shareholding and has continued to

provide strong support for Oxiana’s subsequent gold and copper mine

developments.

Exploration

and Resource Evaluation

Regional exploration of the

broader Sepon area commenced in late 1994 following the discovery and initial

assessment of the Discovery and Namkok deposits. Programs comprising detailed

regional stream sediment and rock geochemistry, geological mapping, airborne

magnetic and radiometric surveys and remote sensed Landsat and photo

interpretation were completed over the entire 5000 square kilometer area in

late 1994 and 1995.

Airborne

magnetics proved useful in regional structural analysis but was of limited use

in direct targeting. Although the porphyry bodies do not have discernable

magnetic signatures, surrounding skarns are detectable. Radiometrics clearly

mapped potassic alteration of the porphyry bodies, including dykes and sills,

where exposed.

Stream sediment geochemistry

(-80#) clearly outlined a standout high order district scale multi-element

geochemical signature over 400 square kilometers around the initial

discoveries. Subsequently, this highly mineralised trend representing the Sepon

Mineral District has been the dominant focus of exploration for gold and

copper.

While exploration at the

district scale has utilised a wide spectrum of techniques and technologies,

programs have always maintained a strong geological focus with an emphasis on

basic prospecting, geological mapping and drilling.

High quality geological,

geochemical and geophysical data has been systematically collected,

progressively compiled, interpreted and revised to develop a solid

understanding of the geology, tectonic framework, and mineralisation at

regional, district and prospect scales.

Detailed

exploration has incorporated geological mapping ranging in scale from 1:25000

to 1:500, soil and rock geochemistry and ground geophysics including IP, CSAMT,

magnetics, radiometrics and gravity. Soil geochemistry on 400 meter spaced lines has been completed over the entire

400sqkm district along with extensive rock geochemistry.

Extensive use of oriented

diamond core drilling early in the project life and the utilisation of a wide

spectrum of specialist consultants to compliment the field skills of the

project exploration team provided a solid basis for understanding the complex

interrelationships between mineralisation, stratigraphy, structure and

intrusive phases.

As part of the project

feasibility studies, a detailed drilling program comprising approximately 900

holes and 30,000 meters was completed in 2000-2002 to evaluate the oxide and

partial oxide components of the gold deposits, and the supergene copper

deposit.

The rapid transition from

exploration to resource evaluation and feasibility required specialist input as

no member of the exploration team had prior resource evaluation experience.

Resource consultants Hellman and Schofield Pty Ltd who had conducted the

resource due diligence for Oxiana’s acquisition of the Sepon project were

contracted to develop and assist implementation of appropriate drilling,

logging, sampling, assaying and quality control – quality assurance protocols

and to upgrade database systems.

Drilling utilising two RC

rigs was completed on a nominal 50 metre drill pattern with priority areas for

early mine development infilled to a 25x25 metre pattern. Diamond core drilling

was used to collect sample for metallurgical test work and to twin several RC

holes in each deposit.

Geostatistical resource

estimates were completed by Hellman and Schofield Pty Ltd using the multiple

indicator kriging (“MIK”) method for gold and ordinary kriging for copper.

New discoveries continue to

be made and exploration for both gold and copper is

ongoing with many targets remaining to be assessed throughout the

district. Development drilling and exploration by Oxiana in the first half of

2003 has discovered two new gold deposits and expanded the gold resource from

3.5 to 4.2Moz (before depletion). An additional discovery of high grade gold

mineralisation approximately 20 kilometers west of the process plant will be

assessed immediately following the current 2003 wet season

Since the commencement of

mining, detailed pit mapping and analysis of grade control drilling data has

been utilised to significantly upgrade geological understanding of the

deposits, in particular the controls on mineralisation. This enhanced

geological framework is being coupled with existing data sets to enhance the

predictive capacity of exploration targeting.

Aggressive drilling

campaigns utilising three RC and two diamond core rigs are continuing to expand

the resource base and test a pipeline of gold and copper targets being

generated.

Geology

and Mineralisation of the Sepon District

Sepon Mineral District

stratigraphy comprises Devonian to Carboniferous aged continental fluvial and

shallow to deep marine sediments deposited in a half graben basin. The

sedimentary package has been divided into nine lithology based formations

(Morris 1995) of which the lower and upper contacts of formation 6, a

calcareous, carbonaceous mudstone host most of the known gold mineralisation.

Sediments generally dip

moderately towards the north and north-west. Dominant fault directions are

north-west parallel to the Truongson fault system and east-west parallel to the

basin bounding faults. The intersection of east-west and north-east trending

faults are important in localising mineralisation and rhyodacite porphyry

intrusive stocks and associated dyke and sill complexes of similar composition.

Four broad

alteration/mineralisation styles are recognised namely quartz stockwork

porphyry Mo, Cu-Au skarn, Cu-Au carbonate replacement, and sediment-hosted Au.

Gold mineralisation is

localised in structural and stratigraphic fluid traps which have many

affinities with the sediment-hosted gold deposits of the Carlin Trend, Nevada,

USA. Mineralisation is finely disseminated and closely associated with

decalcification and variable silica replacement of calcareous rocks along

structures and at lithological contacts. Geometry of the gold ore is controlled

by anticlinal structures and shallow dipping stratigraphy, structure and

porphyry sills. Residual deflation surface remnants of the primary

mineralisation are also recognised.

Copper mineralisation covers

a variety of primary and secondary styles. Along the contacts of the intrusive

stocks, Cu-Au skarns are developed, while outbound of the skarn front lower

temperature silica-sulphide replacement of carbonate rocks is common.

Weathering and mobilization of the primary mineralisation gives rise to a number

of secondary ore types. The Khanong copper deposit is a near surface high grade

supergene derived chalcocite and oxide copper resource derived from weathering

of a replacement style semi massive sulphide body hosted by shallow dipping,

highly sheared carbonate rocks.

In-situ supergene enrichment

of this sulphide protore resulted in the development of a clay hosted, high

grade chalcocite enrichment blanket immediately beneath which lies a very high

grade copper oxide zone comprising malachite ± azurite ± cuprite ± minor native copper (Loader

1999).

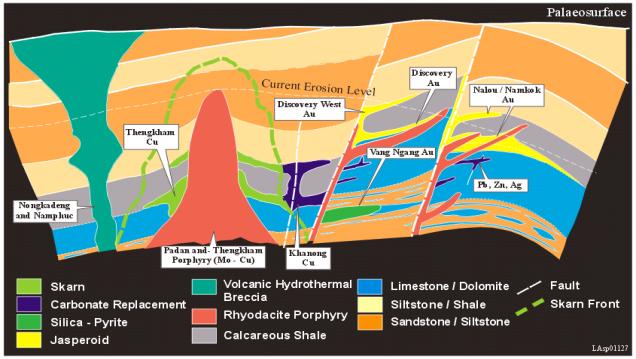

A schematic model showing

the broad spectrum of mineralisation styles represented in the Sepon Mineral

District is shown in figure 2.

Figure 2. Schematic model of

mineralisation styles in the Sepon Mineral District (after Sillitoe 1990)

Project

Development

Background

Following the completion of

all legal and approval documentation for the Sepon project acquisition in

August 2000, development of the project commenced in earnest. Early in the

project development phase Oxiana decided that the most pragmatic approach was

to develop the project in two stages, the smaller gold project first and the

much larger copper project later. The major advantages of this approach included

reduced front end project funding requirements, lesser early stage technical

risk, and the early demonstration of a mining project’s viability in an

untested host country .The following timetable indicates the broad activities

that have taken place since August 2000.

|

August 2000 |

Commencement of Gold FS

and Gold ESIA. |

|

September 2001 |

Completion of Gold FS and

ESIA. |

|

November 2001 |

Commencement of Copper FS

and Copper ESIA. |

|

December 2001 |

Commitment to Gold Project

development. |

|

October 2002 |

Completion of Copper FS

and Copper ESIA. |

|

December 2002 |

First gold poured at

Sepon. |

|

January 2003 |

Commitment to Copper

Project Development. |

|

March 2005 |

Scheduled first production

of Copper at Sepon. |

Gold Project Feasibility

Study (FS) and Environmental and Social Impact Assessment (ESIA)

In August 2000 Oxiana was a

small company with a market capitalization less than AUD30M and few employees.

Oxiana elected to manage the FS and ESIA in-house and to utilize best available

consultants. In this way Oxiana maintained a hands on approach and was able to

provide appropriate direction, while at the same time being assured of having

skilled resources available at short notice. At the time, the Chatree Gold Mine

in Thailand had just completed a FS and Oxiana sought to gain some synergies by

utilizing consultants from that project. Key consultants included:

|

Geology and Resources |

Oxiana and Hellmann &

Schofield |

|

Mining |

AMDAD |

|

Metallurgy |

P. Lewis & Associates |

|

Engineering |

Bateman Limited. |

|

Geotechnical |

Golders. |

|

Environmental & Social |

NSR Consultants and Earth

Systems Lao |

A considerable amount of

drilling and resource evaluation as well as metallurgical test work was

required and therefore in reality the FS was both a pre- feasibility study and

a feasibility study.

Oxiana understood that

project financing requirements would entail an array of international

stakeholders all of whose agendas would need to be fulfilled. A particularly

important party was the International Finance Corporation (IFC) who played a

significant role in setting the terms of reference for the ESIA. This

inevitably added time and cost to the study phase, however the standard of

documentation as well as the IFC’s direct involvement have had downstream

benefits for the project and the company’s dealings with other stakeholders.

Oxiana have continued to adopt the IFC (World Bank) standards during gold

operations and for the copper ESIA.

Although the FS and ESIA

passed all IFC requirements Oxiana was ultimately able to fund the US$45M cost

of the gold project from equity.

Limited funds and a desire

to advance the project as rapidly as possible dictated that only sufficient

resources and reserves to demonstrate the Project’s economic viability were

proved up. It was clearly understood and expected that the resources and

ultimately reserves would be much greater than those developed during the FS.

Gold Project Execution and

Current Status

Oxiana awarded the

engineering and construction of the Gold Project to Ausenco Limited who had

successfully completed the Chatree Gold Mine in Thailand and were also

perceived to have a strength in developing small–medium sized gold mines in

remote environments.

The development of the Sepon

Project had a number of challenging aspects namely a significant wet season for

4 months of the year, no access to power and no telecommunication facilities,

very poor site access by a dirt road which was often cut off during the wet

season and unexploded ordnance across the project site – a remnant of the

Vietnam war.

Nonetheless the Project

produced first gold on schedule in December 2002 and has been operating

successfully for more than 9 months. A study to expand the gold project has

recently been initiated following a significant upgrade of the resources and

reserves (70% increase in reserve ounces).

A key success factor in the

ramp up of the Project was the recruitment of the senior team. All recruitment

was undertaken in-house, typically targeting individuals who along with the

requisite technical skills also needed to have had offshore experience

preferably in Asia on a fly-in-fly-out roster; demonstrated high achievement

and commitment levels; and most importantly a high level of cultural

sensitivity and understanding.

Copper Feasibility Study and

Environmental and Social Impact Assessment

The Copper FS and ESIA were

undertaken in a similar fashion to the gold studies, although the technical

complexity was much greater. As such Oxiana applied increased resources to this

aspect of the work and the engineering company was given a greater over-arching

management role. The team comprised:

|

Management |

Bateman and Oxiana. |

|

Geology and Resources |

Oxiana, Hackman &

Associates, Hellman & Schofield. |

|

Mining |

AMDAD. |

|

Metallurgy |

Bateman, Oxiana, David

Dreisinger. |

|

Engineering |

Bateman / Knight Piesold. |

|

Environmental & Social |

NSR Consultants and Earth

Systems Lao. |

These Studies took 10 months

to complete which included a pilot plant facility at Lakefield Research in

Canada. The process flowsheet comprises crushing and grinding, atmospheric

leach, solid-liquid separation, flotation and pressure leaching. This elegant

flowsheet is anticipated to yield in excess of 90% copper recoveries and

produce 60,000 tpa of LME grade copper cathode.

Copper Project Current Status

In January 2003 engineering

and construction of the copper project was awarded to a joint venture between

Bateman Limited and Ausenco Limited. After 9 months of a 27 months program the

project is on schedule to produce first copper in March 2005. Engineering is

+30% complete, site bulk earthworks are +70% complete and concrete construction

has commenced.

Project Financing

Financing is outside the

scope of this paper, however the financing arrangements and strategy have had a

significant influence on the execution of both Projects.

Sovereign and political

risk, especially from the financial community has always been a major focus

with the Lao PDR perceived as a communist country with little significant

foreign investment track record and no mining infrastructure. Oxiana believed

that this issue had the potential to significantly delay the Project and in the

latter half of 2001 successfully moved to fund the Gold Project entirely from

equity.

Following successful

development of the Gold Project potential investors have been much more willing

to consider investing in Laos and Oxiana is close to finalising the debt

financing package for the Copper Project with a consortium of European

commercial banks, development banks and credit agencies. Adoption of World Bank

Guidelines for social and environmental criteria at an early stage in the

Project’s development has been significant in securing the debt funding

package.

Government

and Community Relations

As discussed earlier, the

Sepon Project is a “flagship” foreign investment enterprise for Laos. The Sepon

MEPA has been successfully used for over 10 years to achieve the successful

implementation of the Project and both parties have abided by the content and

intent of the Agreement without exception.

The Government of Laos is

very open and encouraging of foreign investment and all potential investors who

have visited Laos have been impressed by the support given to the Project by

the Government. Oxiana endeavors to ensure that all four levels of Government

in Laos; Central, Provincial, District and Village are kept informed at all

times and have the opportunity to participate in the development of this Lao

Project.

In any context, potentially

the most important aspect of a successful project is an open, trusting and

sharing relationship with the local community. Oxiana’s philosophy is that our

ultimate mandate to operate lies with the local community and as such Community

Relations takes on a primary role.

Besides job creation and

impacts on the environment, projects in developing countries also have major

impact on social structure, wealth generation and distribution, gender issues,

education, health, capacity building, local area and country development.

Any project in an

environment such as Sepon assumes a large responsibility, not just for the

short term of the mine life, but also for the longer term sustainability of the

area or region in which it operates.

Lessons Learnt

From a project development

perspective a comprehension list of lessons learnt would fill many pages. Key

lessons include:

- social and political mandate is essential for

success;

- whatever your agreement with the authorities -

stick by it;

- hand-pick your consultants – individuals not

companies make the difference;

- the roles of classical sequential project

development are very relevant, but efficiencies and parallel work flows

are always available – despite what your consultants might say;

- for a fast track project development, the

organization structure must not be rigid, there must be no prima donnas,

and access to the decision makers must be available at all times;

- deliver on promises – there is no better way to

develop stakeholder trust;

- use local people, local employees and local

content wherever you can;

- selection of one wrong person at the management

level of the organization has the potential to significantly impact the

success of the Project;

- be prepared to eat and drink whatever is put in

front of you!

References

Gregory, C.J. 1991 Sepon Gold Prospect , Laos. CRA internal memorandum report.

Loader, S.E. 1999 Supergene enrichment of the Khanong Copper

Resource, Sepon Project, Lao P.D.R.. Proceedings

PACRIM’99 pp 263-272.

Morris, D.G. 1997 Sepon Project, Laos: Relationships between

precious and base metal mineralization and stratigraphy, diagenetic alteration

and hydrocarbon generation. Rio Tinto

internal report

Sillitoe, R.H. and Bonham,

Jr. 1990 Sediment-hosted gold deposits: Distal products of

magmatic-hydrothermal systems. CRA

internal report

The Feedjit SMEDG Visitor Map

Which one of the red squares is you?