Discovery and Evaluation of

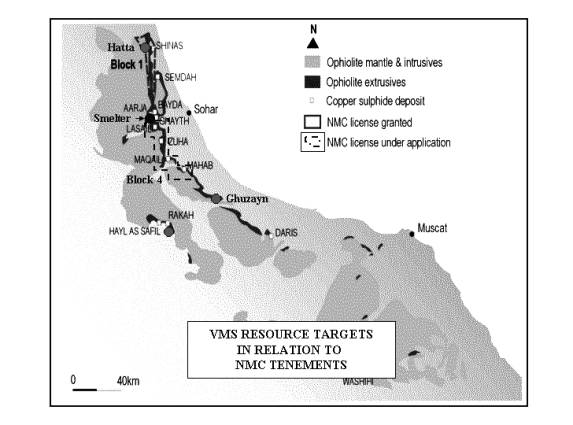

VMS Copper deposits

in the Shinas-Hatta Project,

Oman.

Bob

Close (General Manager)

Mark

Gordon (Senior Geologist)

National

Mining Company L.L.C Tel. (968)

563 057, Fax. (968) 565 401,

Email nmcoman@omantel.net.om,

Website: www.natmin.com

ABSTRACT

National Mining Company

(NMC) is a privately owned subsidiary of the MB Petroleum Group, based in

Muscat, Oman and was set up in 1997 to explore for copper and gold in the Oman

Ophiolite. NMC has spent about US$2.5

million on copper exploration mainly on this project, and over the last three

years to September 2003 has completed 82 diamond drill holes totalling 5808

metres in defining a series of new VMS deposits totalling 3.5Mt of 3% copper.

The current EL Block 1 was

granted in October 2000, with exploration initially focused on possible

vein-breccia gold-copper mineralisation associated with high-level intrusive

complexes. Reconnaissance failed to find evidence of epithermal or breccia

hosted gold mineralisation, so the focus was then switched to traditional VMS

exploration because gold caps are a feature of these deposits in Oman.

The copper deposits are

hosted in submarine basalts of the Oman Ophiolite, a sheet of Cretaceous

Tethyan seafloor that was thrust over basement rocks of the Arabian Shield.

These VMS deposits are typical Cyprus-type and occur in clusters with pyritic

copper-rich mounds with gold bearing gossans overlying lower grade feeder

systems within the footwall basalts.

The Sohar Region has a

history of copper mining dating back to the Bronze Age, with more recent

exploitation being carried out by the government owned Oman Mining Company

(OMCO) on the Lasail Cyprus-type VMS deposits west of Sohar. Since 1970, the

Ophiolite has experienced intensive regional multinational exploration

resulting in the discovery of more than 44M tonnes of 1-2% Cu in three deposit

groups including Lasail.

NMC has employed an

integrated approach in exploring for VMS deposits. Landsat imagery and

aeromagnetic data has been used to target areas of alteration associated with

fluid upflow zones, and then ground geophysics and geological reconnaissance

mapping and geochemistry has been employed to define drill targets. These

copper deposits respond well to EM, IP and magnetics, in cover situations down

to 150 metres.

NMC has discovered five

outcropping deposits, the largest being 2 Mt at 2% Cu at Shinas and 1.5Mt at

3.5% Cu in three closely related deposits at Hatta.

The Hatta deposits are

located at a similar stratigraphic position to other known systems i.e. Lasail,

near the contact of the (V1) Geotimes pillow basalts and the overlying (V2)

Lasail seamount-related basalts. The

Shinas deposit within the Alley Basalt is located much higher up in the

volcanic sequence in a position not previously considered prospective for VMS

mineralisation.

NMC has shown that a

systematic exploration programme, using technically advanced methods combined

with refined geological models and field experience, can be very successful in

finding new resources in areas previously considered unprospective or

thoroughly tested.

The three main deposits are

currently the subject of a Feasibility Study that has carried on from a

positive Pre-Feasibility Study completed in Sept 2002. Following expected completion of a positive

study by the end of 2003, proposed development in 2004 envisages transport of

1M tonnes of ore annually to OMCO’s Lasail Plant where an upgraded Concentrator

will produce saleable copper concentrates. The proposed Capex for development

is US$6M.

EXPLORATION AND GEOLOGY

Regional Geological Setting.

Northern Oman is situated at the eastern boundary of the Late

Precambrian Panafrican crystalline metamorphic basement of Arabian Plate near

its junction with the Eurasian Plate. The Gulf of Oman is a remnant of the

Tethys Sea and overlies a shallow-dipping subduction zone, which extends

eastwards below Iran.

The Oman Mountains are

geologically distinct from the remainder of the Arabian Peninsula, being part

of the Alpine–Himalayan fold belt that extends from the Western Mediterranean

to the Far East. They result from

obduction to the southwest of Cretaceous Tethyan oceanic lithosphere over both

autochthonous and allochthonous carbonate platform sequences that host the

major petroleum resources in the Region.

Ophiolites in this

convergent margin Tethyan Suture Zone setting are prospective for chrome,

nickel and Cyprus-type VMS deposits, and the excellently exposed 800 km long by

5-10 km thick Semail Ophiolite Belt in Oman is no exception.

Historical Exploration

Ancient copper

mining and smelting in the Sohar region based on VMS deposits provided a major

source of metal for early Bronze Age cultures in Mesopotamia, and this

development continued into the Middle Ages during the rise of Islam.

The Omani Government has since 1970 sponsored regional mapping and

systematic exploration conducted by various International Mining Groups. Early workers used

standard prospecting and reconnaissance geochemical methods to locate the

obvious old workings and drill tested the most significant prospects, resulting

in the discovery of most of the outcropping VMS copper deposits in the region.

The low-grade Sohar pyritic deposits totalling 14 M

tonnes were subsequently mined during a period of high copper prices from

1983-1994 by the Oman Mining Co at Lasail, Aarja and Bayda.

Since 1990, Omani Government

sponsored exploration by OMCO, JICA and Bishimetal in the Yanqul, Ghuzayn and

Daris areas has resulted in the discovery and definition of 17M tonnes of

massive sulphide and stockwork sulphides in five gossan associated deposits

averaging 1.2 % Cu, 1g/t Au at Hayl al Safal-Rakah. They were also successful recently at Ghuzayn where drilling of geophysical

targets resulted in the discovery of 14 million tonnes of 1.4 % Cu in several

blind deposits at depths of 100 to 250m.

These companies focused on

peak IP chargeability targets with coincident TEM responses within the

prospective volcanics and drill tested all metal factor anomalies.

None of these sulphide

deposits have been exploited to date because repeated Feasibility Studies have

shown the resources were uneconomic due to their overall poor quality, high

capital requirements for development and historically low copper prices.

VMS

Exploration Strategy

All major mines

and most prospects, including Hatta, Lasail, Aarja, Bayda, Ghuzayn, Rakah, Hayl

as Safil and adjoining ore bodies, are not only at the top of the V1 Geotimes

Unit or just within the V2 Lasail Unit, but also less than several kilometres

from either ultra high-level intrusive complexes or interpreted primary

syn-volcanic faults associated with the Lasail phase of magmatism. These Cu-Au deposits are spatially related

to volcanic centres that had high associated heat flow and hydrothermal fluid

discharge focused through key structural zones marked by altered and

demagnetized areas. These features

conceptually provide very valuable criteria in exploring for gold and base

metal mineralisation elsewhere within the Semail Ophiolite.

NMC’s overall

strategy has been to utilise detailed Aeromagnetic and LandSat data to

highlight prospective alteration zones in favourable stratigraphy, and

following ground inspection for gossans has tested these areas with ground

magnetic, IP and TEM surveys.

It is apparent

from drilling that the geophysical expression and in particular the TEM

anomalism, at these shallow VMS deposits, is a reliable indication of the

extent of massive sulphide mineralisation and resource potential. Therefore on going

regional exploration will focus on areas where significant hydrothermal

alteration has occurred. TEM surveys will then be used to evaluate the

prospective stratigraphy for new blind deposits at shallow depth.

NMC Exploration

In early 2001 the Hatta–Shinas area was selected for initial detailed

evaluation for VMS deposits because we recognised the strong footwall-type

alteration in Landsat images coincided with major structures and an extensive

magnetic depletion zone at Hatta, as well as a discrete low around the Shinas

”gossan”. Earlier prospecting had identified several small structurally

controlled copper-bearing gossans at Hatta West and Ajib, but focussed mapping

in March discovered three new gold-copper bearing gossans at Hatta.

The largest gossan in Wadi Hatta together with the Shinas prospect were

then selected for geophysical evaluation and each gave discrete TEM conductive

and IP chargeable responses typical of massive sulphides at shallow depth. These prime targets were then tested at 100m

centres in Stage 1 diamond drilling in April-May, which confirmed they host +20

metre thick zones of relatively high-grade 2-4% Cu massive sulphide

mineralisation.

This

successful result was achieved due the combination of experienced field

geologists using flexible geological models and superior technical data derived

from the latest Landsat, Aeromagnetic and ground geophysical interpretative

techniques. These discoveries were

sufficient to warrant a major programme of exploration to properly define the

scale of mineable resources in this district.

Stage 2 and Stage 3 detailed infill NQ resource drilling of these

deposits was carried out at 25m-40m centres totalled 3074.15 metres in

forty-eight drill holes. The gossans generally exhibit low- grade gold around

1/g/t Au and tend to cut out at shallow depths into supergene massive

sulphides, therefore little effort was made to quantify oxide resources and the

focus was on the main sulphide deposits.

DEPOSITS

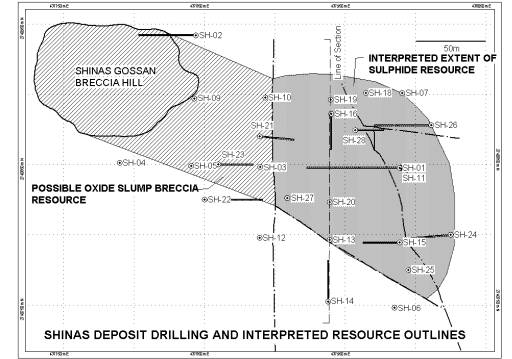

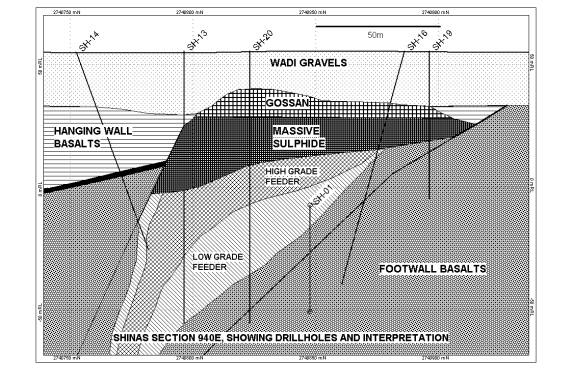

1.Shinas

Shinas is the largest

(1.9Mt) deposit in the project by virtue of its extensive sheet of massive

sulphides and well-developed stockwork system compared to the smaller but

richer massive sulphide dominant deposits at Hatta.

The margins of this roughly

oval in plan (150m x 125m) to funnel shaped deposit at depth, are partly

constrained by syn and post volcanic faults within the host basalt

breccia-hyaloclastite unit and overlying massive oxidised lava. A steep ESE trending early structure the

“Southern Fault” and the similar northerly trending ‘Western Fault” mark two

sides of the system. They control a focused stockwork stringer (QVS) zone at

80-150m depth that expands upwards beneath an extensive shallow dipping 10-35m

thick semi-massive to massive sulphide seafloor breccia apron that is capped by

gossan, mineralised sediment and fringing hanging-wall basalt.

The sulphide mound facies is

typically pyritic and brecciated with siliceous and chalcopyrite-rich infill;

it contains significant gold at the northern and eastern margins in SH-01, SH-16

and SH-21. The central mound intersected by SH-20 and 27 provided MS zones of

35.5m at 1.73 % Cu and 47.3m at 2.1% Cu respectively. Sub-mound replacement

breccia mineralisation grading down to dominant QVS material is typically

chalcopyrite-rich grading 1-3% Cu, with weak gold. All grades attenuate at depth in the moderate to weak stringer

mineralisation, however average grades over 1% Cu continue to 100-110m depth in

the core zone.

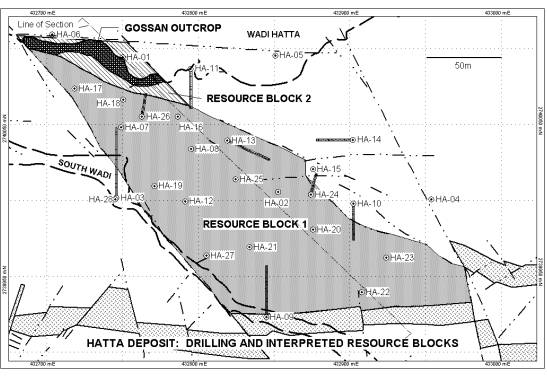

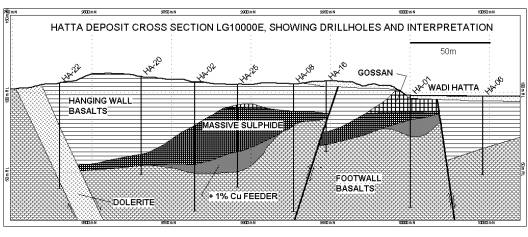

2. Hatta

This 200m long by

100m wide SE trending pyritic massive sulphide lode containing 0.9Mt at 3.5%

Cu, is very coherent and consistently mineralised, but has a strikingly

copper-rich mound centred on HA-25 containing 8.45m at 11.3% Cu. This lies

within a 33 metre thick zone of primary sulphides commencing at 15m and

extending at depth into a chlorite-haematite-pyrite stringer zone.

The deposit is

controlled on all sides by post mineralisation faults trending E-W and ESE-SE,

and wedges out towards the margins where elevated zinc and locally gold grades

represent cooler parts of the mineralised system, for instance HA-16 has 7.55m

at 1.65g/t Au, 8.97% Cu and 3.1% Zn in primary sulphides.

The exposed gossan

(totalling perhaps 0.1Mt at 1g/t Au) at the northern end along Wadi Hatta

grades south at depth into a thin chalcocite-rich supergene zone averaging

5.56% Cu over 7m in HA-16.

3. Hatta

Extended

Five shallow holes HE-04 to

HE-08 in Stage 3 drilling tested the potential strike and dip extensions to the

high-grade primary and supergene mineralisation intersected in Stage 2 drill

holes HE-01&-02. Similar high-grade

intersections in HE-04 (3.4M @ 7.47% Cu) and HE-05 confirmed the strong TEM

anomaly and weak IP expression is associated with two thin parallel shallow

dipping massive sulphides lenses with limited stringer mineralisation. However, the later holes HE-06 to –08 served

to outline the limits to this small deposit.

4. Hatta South

This deposit is 150m long

and 80-100m wide and extends from a small gossan to the west along a SE plunge

to a mound centred on the HS-05 which coincides with the peak TEM response.

HS-05 provided a 25metre thick pyritic MS breccia mound intersection assaying

24m at 2.58% Cu from 16m depth above a proximal stringer zone. The deposit is faulted or wedges out

rapidly to the east and north but extends as a 20º south dipping sheet gradually

thinning to the south of HS-08 which intersected 10.4m of 3.82 % Cu at 45

metres.

HS-03 sited 40m down dip

from the gossan provided an initial excellent shallow ore intersection of 4.6m

of high-grade massive sulphide from 23.3m assaying 7.40% Cu, 6.48% Zn, 0.79g/t

Au and 38g/t Ag. The presence of unusually high zinc grades to 13% Zn at the

top of the MS in HS-01 and -03 represents late seafloor sulphide deposition at

the cooler periphery of the system.

Technical

and Financial Evaluation

Resources

Preliminary

resource evaluations for Shinas and Hatta were presented in the Pre-

Feasibility Study. The combined sulphide resources at Shinas were calculated at

1.88M tonnes at 2.9% Cu, 0.55g/t Au, whereas at Hatta the resource was 0.9M

tonnes at 3.1% Cu, 0.9% Zn and 0.3g/t Au.

After the

Stage 3 program of detailed infill drilling at 25m centres, these main

resources were confirmed and increased marginally to approximately 3M tonnes at

3% copper. The resources in the other Hatta deposits have a combined total 0.5

M tonnes but only the Hatta South resource of 0.35Mt at 3% Cu is presently

considered mineable.

A high-grade

central mound feature was defined in all three main deposits with HA-25

intersecting 33m @ 7.2%Cu and SH-27 intersecting 47m @ 2.1%Cu. At Hatta the

HA-25 zone served to bring the overall grade of the deposit to 4% Cu.

Definition

drilling at Hatta south is ongoing, however estimated resources are 0.35Mt at

3.5% Cu with generally low Au and Zn except along the northern margin.

At Hatta

Extended drilling was disappointing and resulted in the indicated resource

being confined to 100,000 tonnes at 4 %Cu and 0.6 g/tAu within two thin

sub-parallel lenses.

There could be

up to 0.4M tonnes of gossan grading 1-2g/t Au at Shinas and Hatta, which may

respond to CIP treatment, however this is not part of the current Feasibility.

More rigorous resource definition is now underway including block

modeling by independent consultants to determine the reliability and

variability of the resources. It is

clearly evident that these shallow copper sulphide resources represent the

basis for an attractive open pit mining operation in this district.

Feasibility and Development

NMC has over 3 years organised an experienced

team of mainly Australian consultants who completed a Pre-Feasibility Study in

August 2002 that indicated developing these deposits was economically viable

with a Capex of only US$6M, if the sulphide ore is trucked to Lasail and

processed through a refurbished 20-year old concentrator.

NMC is now undergoing a commercial

Feasibility Study costed at US$1M and due for completion this December. This

will verify the mineability of the resources, confirm the optimal floatation

processing system to be installed in the refurbished Lasail concentrator and

the viability of a new tailings waste disposal system at the nearby old Aarja

mine pit.

It is intended

that commissioning of the mines and plant will take place within 6-8 months of

receiving development approval from the Government and finalising agreements

with OMCO and engineering contract groups.

All the mining, transport of material and treatment process operations

will be conducted by contracted specialist consultants directed by NMC

professional staff. There is sufficient local expertise and regional based

groups in the UAE to provide a quality workforce.

It is intended to

commence pre-strip contract mining by the end of March, and to mine at the

annual rate of 1M tonnes of ore at an average grade of 3% Cu and 0.4 g/t. This

will produce approximately 22,000t of copper and 8,000oz of gold annually which

could generate annual revenues of US$38 million from concentrate sales and

potential cash flow of US$16 million using a copper price of 75c/lb. Therefore

capital payback may occur in the first full year of operation.

CONCLUSION

NMC has shown

that superior exploration methods will result in discovery of new deposits

within areas previously considered thoroughly tested. Understanding of regional

metallogeny and use of advanced technology plus dedicated geological footwork

provides a potent combination for successful exploration.

Proposed

treatment of ore utilising the Governments existing facilities greatly reduces

the capital required for development and establishes synergy with OMCO by

providing local concentrate for smelting.

NMC has only

started its campaign to revitalize the Oman mining industry and this initial

small development will serve to generate the capital to undertake much larger

projects that will underpin its future and guarantee NMC a pre-eminent position

in the region.

Reference:

Close, R.J., Gordon, M.J., and

Al Jabri, S.N., 2002. Mineral Exploration Licence Block 1 Sultanate of

Oman. Annual report for the Period

ending 8thOct 2002. National Mining Company L.L.C.(Unpubl)

The Feedjit SMEDG Visitor Map

Which one of the red squares is you?