CHATREE. A GREENFIELDS DISCOVERY

IN THAILAND.

M.G.

Diemar

Kingsgate Consolidated NL.

Level 17, 33 Bligh Street

Sydney. 2000 Australia

ABSTRACT

The discovery and definition of the Chatree gold deposits in Central

Thailand resulted from the efforts of a

small dedicated team over a long period of time backed by shareholders with

unreasonable faith. Total official

resources to date are 14.6 million tonnes at 2.7 g/t Au and 12 g/t Ag for 1.2

million ounces of gold, discovered and advanced through Definitive Feasibility

for US$6 per ounce gold equivalent.

Exploration commenced in the year of King Rama IXs, 60th

birthday (1987) and continued throughout his 6th (12 year) cycle.

Exploration costs were kept at an affordable level for a junior company

by, keeping overheads low and by adopting a mixture of modern gold exploration

concepts combined with traditional prospecting techniques, using only one part

time expatriate to guide a team of Thai geologists and ensuring that drilling

was carried out early, with genuine targets at a controllable rate.

At Chatree gold occurs in an adularia-sericite epithermal system within

quartz-calcite-adularia veins, breccias and stockworks in a host intermediate

volcanic arc sequence of Triassic age.

The project is anticipated to be in construction during 2000.

The art of being successful in Thailand is related as much to ones

ability to think long term and to appreciate the country’s culture, history and

confucian business systems as to ones ability to find gold.

INTRODUCTION

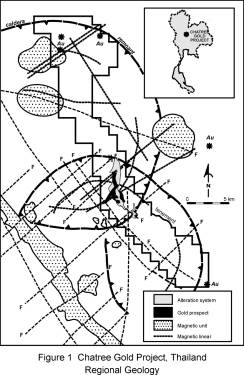

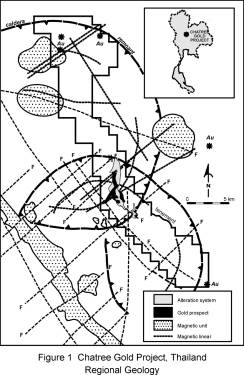

Chatree is located on the

eastern edge of the Tertiary Chao Phraya Basin in gently undulating farmland

280 km north of Bangkok, on the border of Petchabun and Pichit Provinces as

shown on Figure 1.

The project consists of five

defined prospects (A,B,C,D and H) within an alteration area of 7.5km by 2.5km

in gently undulating farmland.

The prospects occur within a

north-south trending Upper Permian and Triassic volcanic arc sequence formed

above subduction associated with the collision of the South-East Asian and

Shan-Thai crustal blocks. The volcanic

belt contains low sulphidation epithermal gold, copper/gold skarn and porphyry

copper occurrences. Hard rock mining of

malachite and magnetite from skarn has taken place in a number of locations in

this belt over the last 4000 years dominantly during the bronze and iron

ages. Minor alluvial gold has been

produced at the village level in the northern half of the belt, mainly within

Lao PDR.

Chatree is a greenfields

gold discovery however we recently became aware of local folk-law describing

minor colluvial and alluvial gold workings by slaves of the Japanese during

World War 2 and by unknown parties during the reign of King Rama IV about 100

years ago in areas approximately 10 km south and 10 km east of Chatree.

HISTORY OF EXPLORATION

PERIOD OF UNBRIDLED

ENTHUSIASM 1987-1988

Thailand was chosen as an

exploration target in 1987 when foreigners were, for the first time, allowed to

explore for gold. Good regional

logistics in this very stable country with a mature mining law and reasonable

gold and copper prospectivity were the determining factors in attracting the

company.

Exploration commenced

pre-crash in 1987 by Epoch Mining NL in joint venture with Kulim Limited and a

private Australian partner. In late

1987 the writer rejuvenated the almost defunct joint venture and with the

in-country help of Robin McQueen an Australian expatriate, set up a simple

corporate structure, (Thai Goldfields Limited), an office and a team of one

senior and five junior Thai geologists in Chiangmai.

Initial work included visits

to every gold occurrence known to the Department of Mineral Resources (DMR) and

every location having gold in its name, recorded the Thai 50,000 topographic

sheets, of which there were large numbers. eg Gold Nugget Creek, Village of

Gold Pits etc. This was a worthless

exercise as most hardrock gold were minor skarn styles and the alluvial

occurrences could not be related to hardrock sources. In addition it was concluded that alluvial gold should be the

province of the local villagers and known hardrock occurrences generally had

associated “difficulties”.

Based on metallogenic

studies and regional conceptual targets a regional prospecting concept was

introduced to the team by the writer.

This was based on some very simple premises:

1.

About 30% of Thailand required exploring.

2.

No modern gold exploration had taken place and Thai geologists were only

familiar with

quartz vein and skarn styles.

3.

The joint venture had limited funds.

4.

The ability to raise further funding was diminishing.

5.

In-country gold assays were unreliable and >US$35 per sample.

6.

There was no competition for ground so it was possible to explore without

title.

7.

The writer would run Epoch Mining NL and the joint venture from Australia and

commute

to the field regularly to train Thai staff

and to vet past work and plan forward programs.

8.

All work would be carried out in a low key manner.

Classical style exploration

of this large area was clearly not possible and multiple field teams were

organised to carry out rapid reconnaissance prospecting over large areas of the

main gold belts including slate belt vein styles in the west, disseminated gold

arsenic antimony in Prae-Lampang, gold-barite associations on the peninsular,

in Mae Hong Son and Loei and epithermal/skarn/porphyry Cu models in the far

north, in Loei and in the Petchabun Belt.

The tools used were regional

geology, definition of metallogenic belts, mineralisation models, rapid

reconnaissance mapping, panning of soils above break-of-slope and alteration

mapping.

Panning was considered a

suitable technique for reconnaissance gold geochemistry in these South-East

Asian terrains (latitude ±16 degrees north) where laterisation resulting from

the dry monsoonal climate was predicted to have resulted in pannable sized gold

grains being developed overlying even fine grained epithermal styles.

About 5 man years of field

work was completed in this period which defined a very large number of targets.

Pannable gold was first noted at 1508 Prospect at Khao Mo (now A Prospect of Chatree) and from many other similar hills in the Chatree district by a Thai Goldfields Limited team, including Khun Chatree, in July and August 1988 during a prospecting sweep utilising soil panning above break of slope as the primary exploration tool. The potential at 1508 as a significant epithermal gold prospect was recognised by the writer in September 1988, during a periodic screening and prioritising of all new Thai Goldfields’ targets, with recognition of epithermal textures including crustiform veining and hydrothermal breccias.

The following policies were

formulated at this time, which brought the main reconnaissance phase to a

close.

1. Delete the following areas from the “potential targets” map. Mountainous (watershed, erosion) areas, some categories of forestry reserves, all national parks and many other reserve categories, heavily populated areas, areas within 10 km of known provincial strong men, military areas (past, present and future), large areas of farmland with ill-defined land title, later to be designated Sop Or Kor, areas with elephantitus, and a number of other uncategorised areas.

2. Concentrate on epithermal styles in the Loei and Petchabun belts as they have the best metallurgical, environmental and logistical factors associated with them.

3. Focus on a small number of the best targets

and try to make a success of them.

PERIOD OF FOCUSSED

ADVANCE 1989-1990

Prospect 1508 was chosen as

the highest priority target and in the ensuing period received about 60% of the

exploration effort.

It was a hill 110 metres

high and 950 metres long trending at 005 degrees. Detailed grid based C horizon hand auger geochemistry, float

sampling and later 800 metres of hand dug trenching were undertaken which

outlined a strongly gold anomalous zone in soil and bedrock at greater than 0.5

ppm Au over a width of 150 metres and a length of 1300 metres trending at 350

degrees, the regional structural direction.

The trenching to bedrock

confirmed the C horizon geochemistry with results as follows.

|

Trench |

Result

(ppm Au) |

Trench |

Result

(ppm Au) |

|

T1 |

Not sampled |

T7 |

21.3m @ 2.0 |

|

T2 |

38.5m @ 1.7 |

T8 |

69.9m @ 2.9 |

|

T3 |

68.5m @ 1.4 |

T9 |

27.6m @ 1.0 |

|

T4 |

23.1m @ 1.4 |

T10 |

123.0m @ 1.4 |

|

T5 |

22.1m @ 1.6 |

T11 |

7.2m @

1.6 |

|

T6 |

4.9m @ 2.1 |

T12 |

76.6m @ 0.6 |

Many of the trenches stopped

in mineralisation.

Limited regional auger

geochemistry on short east-west lines, north and south of 1508, was largely

unsuccessful.

Regional prospecting and

exploration in this and other districts, mainly on a series of epithermal

targets was carried out with reasonable results.

The success at 1508

coincided with a difficult financial period for the joint venture.

The following conclusions

were arrived at which brought this productive period to a close.

1. It would be necessary to obtain stronger

title to the prospect before further serious work

could be justified.

2. It would be desirable to bring in a partner,

preferably Thai, to support the project.

PERIOD OF PAIN AND

SUFFERING 1990-1995

A limited field program was

maintained initially, but a serious lack of available funds and to a lesser

extent, a lack of confidence by some, in our ability to gain strong mineral

title to the project, led to a suspension of field work and eventually to a

disbanding of the Thai Goldfields technical team.

The administration side of

the company continued to pursue title and maintain assets while partners were

sought. The company’s name was changed

to Issara Mining Limited to lower our profile.

Over a period of 18 months,

major Australian, Canadian, French and Dutch groups come close to joint

venturing the properties but failed to commit.

Epoch Mining NL withdrew

from the exploration scene and in mid 1993, its Thai interests were sold to

Kingsgate Consolidated NL. The writer

went with the properties.

Efforts were directed to

finding a Thai partner and in late 1993 a letter of intent was signed with Ban

Pu Co., Ltd giving them a 51 % participating interest in the 1508 project and a

joint venture company Akara Mining Limited was formed.

Special Prospecting Licences

(SPLs) were applied for by the joint venture over 1508 and its potential

extensions.

In 1994 the DMR formulated a

policy to cancel all of the applications and to create reserves over the

district for the purpose of tendering to exploration companies. This led to a 12 month period of uncertainty

until the policy was dropped.

In June 1995, the SPLs were

granted and exploration by the writer and Ban Pu staff commenced.

No flashes of wisdom

appeared at this time; it was just a relief to be busy.

PERIOD OF SUCCESS 1995-1999

Subtitle – False dawn. July,

1995 to August 1996.

Exploration commenced in

July, 1995, at the beginning of the heaviest wet season in Thailand for 10 years. The program included RAB bedrock drilling at

1508A Prospect (previously 1508 Prospect) and 1508B Prospect (discovered by the

DMR in about 1992/3, 5 km south-east of 1508A Prospect). A number of encouraging intersections were

recorded.

The centrepiece of the

program was a 14 hole diamond drill program on 1508A Prospect with 4-5 holes on

each of 3 lines, 200 metres apart, across the geochemical anomaly, which

resulted in the following interesting, but to the joint venture, basically

disappointing intersections.

DDH39 12.8

m @ 3.17 g/t Au & 21.5

g/t Ag

4.0 m @ 2.97 g/t Au & 28.4

g/t Ag

DDH36 58.0

m @ 1.39 g/t Au & 38.6

g/t Ag

21.0

m @ 2.37 g/t Au & 50.9 g/t Ag

DDH38 31.0

m @ 1.60 g/t Au & 14.2

g/t Ag

DDH32 50.8

m @ 2.01 g/t Au & 5.4

g/t Ag

1.2 m @ 51.00 g/t Au & 70.0

g/t Ag

Remember - hopes were high.

Due to the inconclusive

nature of the results, there was an hiatus in the program while further budgets

were argued and approved and fieldwork was only recommenced when the heat had

built sufficiently, late in the dry season.

During this inactive period,

Kingsgate’s equity in the project was increased from 31.6% to 90% as described

below.

Following orientation

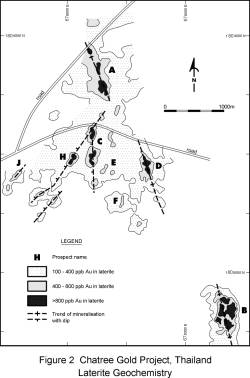

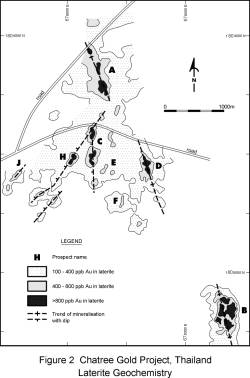

sampling, a regional grid based auger laterite sampling program was completed

over the pervasive silica alteration system.

Laterite samples were taken to avoid surface contamination from gold

bearing silicified volcanic material derived from local quarries and used on

provincial and farm roads.

Strongly gold anomalous zones of a similar tenor and

size to that existing at 1508A were defined in very gently sloping country

between 1508A and 1508B Prospects as shown on Figure 2.

As the monsoon approached

and the anomalous areas were being prepared by farmers for corn planting, a

hurried bedrock RAB program was completed to determine if the laterite

anomalism extended into the bedrock in a meaningful way.

Subtitle – Success at last. July, 1996 to present.

ASX release dated 28 June, 1996. “…11 of 12 RAB holes drilled, intersected

greater than 1g/t Au over 2 metres.

Three vertical holes, 200 metres apart north-south, drilled to 25 metres

into bedrock were located on the southern section of the westernmost anomaly. The two most promising results were,

RAB93 10.0m @ 4.01

g/t Au

RAB95 10.0m @ 19.34 g/t Au and

9.0m @ 3.84 g/t Au.

This zone is now designated PROSPECT 1508C.

The other 9 vertical holes, drilled to 25 metres into

bedrock were located on three east-west lines over a north-south strike length

of 600 metres on the easternmost anomaly.

The northern line returned the most promising results with three holes

at 40 metre spacings assaying as follows,

RAB100

4.0m @ 1.42

g/t Au and

6.0m @ 5.32 g/t Au.

RAB101 25.0m @ 7.01

g/t Au

RAB102

2.0m @ 1.12

g/t Au and

17.0m @ 7.65

g/t Au

This zone is now designated PROSPECT 1508D.”

The receipt of these results for C and D Prospects, represent the

defining moment of the Chatree Project.

Work completed to date on C

and D Prospects and later H Prospect has included:

498 RC, DDH and combination

RC/DDH holes for 38,759 metres of which 23, 317 metres were core.

Drill sites were generated

by targetting the 0.8 ppm Au in laterite contour until the mineralisation was

outlined then infilling to generally 25 x 20 m spacing for resource definition.

107 trenches for 5,708

metres were completed at the end for resource sampling purposes.

10 fully cored geotechnical

holes were completed.

3 full size water production

holes were completed.

35 sterilisation RC holes

for 1,525 metres were completed.

The Busang fiasco and a long

stockmarket and gold price decline resulted in increased project expenditures

to ensure the highest quality of all project and testwork data.

Independent pre-feasibility,

interim feasibility, definitive feasibility and Environmental Impact Assessment

studies were completed.

This work has led to the

definition of viable gold reserves located within a structurally controlled

quartz, carbonate, adularia epithermal system, able to be mined by open cut

methods with gold extraction in a standard CIL plant.

Mining Lease applications are proceeding well with the

Environmental Impact Statement being the last document requiring approval. Construction is anticipated to be commenced

in early to mid 2000.

RESOURCE GROWTH C, H

and D Prospects.

The following formal

resource estimates show the steady growth in resources in C, D and H prospects,

and reflect the success of the field programs.

The other prospects have not advanced to resource status yet due to lack

of drill density.

Stage Resource Tonnes Grade

Au g/t Oz Au Date

Prefeasibility Ind+Inf 4,200,000 3.1 422,000

Oct 1998

Initial with H Ind+Inf 6,500,000 3.3 700,000

Nov 1998

Interim m+Ind+Inf 12,700,000 2.5

1,004,000 May 1999

Feasibility m+Ind+Inf 14,500,000 2.6 1,200,000 Sep 1999

MINEABLE RESOURCE/RESERVE GROWTH C, H and D Prospects only.

The pre-feasibility and

interim feasibility studies were based on mineable resources as the Whittle

runs included Inferred Resources. The

Definitive Feasibility was based on correctly derived reserves which resulted

in slightly lower contained ounces because Inferred Resources were not included

and a gold price of US$260 was used rather than US$275 as in the

Interim-feasibility..

Stage Category Tonnes Grade

Au g/t Oz Au

Date

Prefeasibility Ind+Inf 3,700,000

3.1 373,000 Nov 1998

Interim Feas. m+Ind+Inf 9,600,000

2.7 825,000 Mar 1999

Feasibility Prov/Prob 8,200,000 3.1 807,000 Sep 1999

PROJECT PARAMETERS C, H

and D Prospects only.

The basic parameters of the

Definitive Feasibility are as follows.

Annual Production Schedule

|

|

Year

1 |

Year

2 |

Year

3 |

Year

4 |

Year

5 |

Year

6 |

Year

7 |

Total or Average |

|

Mill Feed Million tonnes/year |

0.9 |

1.0 |

1.4 |

1.5 |

1.5 |

1.5 |

0.4 |

8.2 |

|

Mill grade Gold

(g/t) |

4.6 |

4.4 |

3.6 |

2.5 |

2.8 |

2.1 |

0.9 |

3.1 |

|

Mill grade Silver

(g/t) |

25 |

21 |

18 |

11 |

11 |

10 |

7 |

14 |

|

Gold equivalent recovered(oz x 1000) |

138 |

140 |

152 |

107 |

122 |

91 |

10 |

759 |

Project Parameters -

Definitive Feasibility Study. C, H and

D Prospects only.

|

Total Operating Costs |

US $85.0 |

million |

|

Pre-production Capital Costs (new equipment) |

US $29.8 |

million |

|

Sustaining Capital |

US $6.0 |

million |

|

Gold price US320/oz |

|

|

|

Total Revenue |

US $242 |

million |

|

Net Cashflow |

US $115 |

million |

|

Internal Rate of Return |

95.6 |

% |

|

NPV at 8% discount |

US $84.8 |

million |

|

Payback Period |

12 |

months |

|

Cash Costs Years 1, 2 and 3 |

US $91 |

Per oz Au equivalent |

|

Cash Costs Total Project |

US $117 |

Per oz Au equivalent |

|

Production Cost Total Project |

US $169 |

Per oz Au equivalent |

The project will be one of

the lowest cost producers in the world.

HISTORY of EQUITY

The self explanatory

calendar of equity involvement of the company that the writer represented

varied through time as follows.

|

Year |

Equity % |

Comments |

|

1987 |

33.3 |

Commencement |

|

Early 1988 |

66.7 |

Epoch purchased Kulim

share |

|

1989 |

64.4 |

Shares in Thai entity

issued to Thai staff. |

|

1993 |

64.4 |

Epoch share purchased by

Kingsgate |

|

1994 |

31.6 |

Ban Pu farms in for 51% |

|

March 96 |

33.3 |

Kingsgate purchased Thai

staff equity |

|

March 96 |

49.0 |

Kingsgate purchased equity

of Australian partner. |

|

May 96 |

90.0 |

Kingsgate purchased back

portion of Ban Pu equity |

FINANCE

Perhaps the greatest

compliment to those involved in the project came at the Interim Feasibility

stage (before final resources and Definitive Feasibility and at a US$260 gold

price) when a reputable Australian resource bank, offered 100% pure debt

financing of the project

LESSONS LEARNT (which apply to the small company approach).

If you believe in a project

fight for it. Always show your strong

intent. Be single minded.

Patience is not a virtue it

is a survival mechanism. Speed kills.

The shortest distance

between two points is not a straight line.

Learn to recognise if you

have a problem.

Learn to identify the

problem.

Deal with the problem

immediately.

Never take you eye off the

ball or it will disappear.

Use trusted national staff

in all dealings with nationals.

Budget size often has an

inverse relationship to success as time kills the enthusiasm of backers.

Develop a wide network of

national information contacts (spies).

Maintain a very low profile.

Equity is king.

Technical excellence is

essential in prospecting and exploring. (something geological at last)

Above all things, remember

you are a guest in the country.

THE FUTURE

The Chatree Gold Project has

strong simple technical and financial fundamentals which when combined with the

enormous potential for further discovery in the immediate surrounds will ensure

a very long life for this new goldfield for which all of those people who have

contributed to its discovery and definition can be justly proud.

ACKNOWLEDGEMENTS

I wish to acknowledge the

contribution to the Chatree Gold Project of Surapol Udompornwirat, Suphanit

Suphananthi, Pornthep Suwannachote, Abhisit Salam, Thibdee Sookhook, Kitipong

Kongsawast, Mike Garman, Charnwit Premgamone, Aroonwadee Smarnmit, Chatree

Chaicanapoonpol, Surapol Pikraungan, Sirinya Ponsonda, Chamrat Sangsrichan,

Nopadon Chinabutr, those unnamable souls and those many people involved in the

feasibility and other studies. .