Angela Lorrigan

Geology Manager, Pasminco Elura Mine, Cobar NSW 2835

Key Words Cobar Elura Nymagee exploration CSA Siltstone

In early 2001 the shadow of declining zinc prices began to fall over Pasminco, a company already made vulnerable by its large debt and hedging positions. By September of that year, with the zinc price at $US745/tonne, the company entered voluntary administration.

The combination of ever-declining zinc prices and being in administration put pressure on the Elura operation in numerous ways. In particular responses had a significant impact on the exploration strategy employed over the past year: these were:

A tight control imposed on spending both before and after entering Administration.

The deep drilling programme had been terminated in early 2001and although provision for some exploration drilling had been made in the plan, little of this had been spent.

The decision to sell Elura .

This highlighted the need to maximise the value of the resource in order to strengthen the asset.

An urgent need to find more ore was thus combined with a climate of uncertainty and an incapacity to spend. This paper outlines the strategy being used to cope with the situation. In so doing it also shows how important an understanding the geology is to making every metre of drilling count. How regional and mine based exploration programmes assist each other and how important it is to persist with exploration, not despite the uncertain times but because of them.

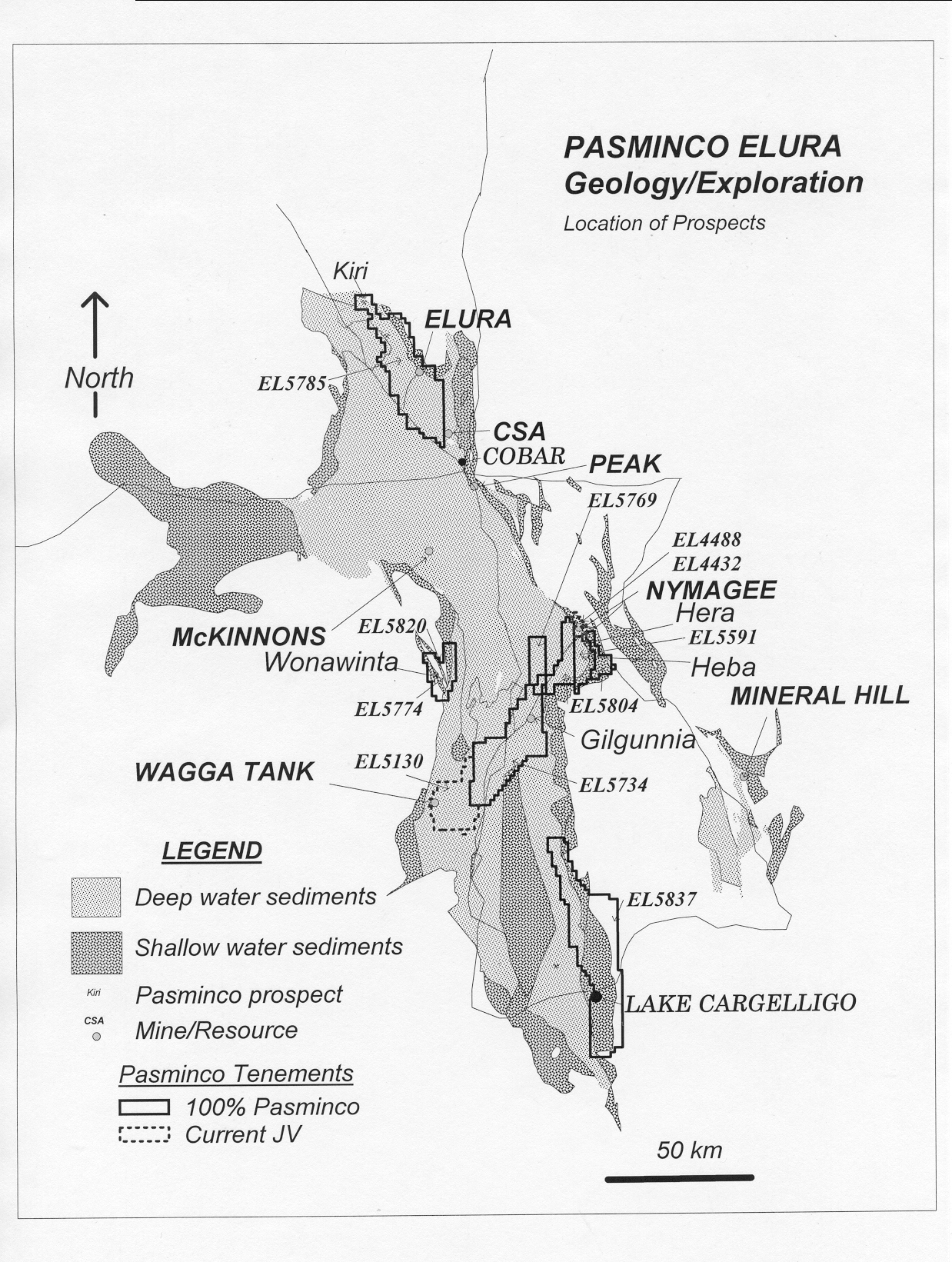

The Elura geology team consists of a manager, two mine geologists, a regional exploration geologist and a core shed assistant. Although job descriptions are specific to mine exploration and regional exploration the small team size allows discussion between all geologists. Also, when workloads are high in an area personnel from the team are called on to help out. The Elura Mine Lease area and other tenements held by Pasminco in the Cobar region, are shown in figure 1.

Once Pasminco had entered into administration the sale process for Elura, initiated prior to September 2001, was accelerated. The exploration tenements are to be included in this sale process. To retain the tenements the expenditure commitments had to be met. On the mine the need to find additional ore was critical and an efficient drilling programme was required.We turned to the task of how to best spend our precious resources.

Figure 1. Location of Pasminco tenements and prospects in the Cobar area.

Exploration strategy and direction since administration

Mine Exploration

The area of most urgency was mine exploration and this was tackled first. In order to make the most of our drilling in the mine area it was critical to identify the key controls on mineralisation.

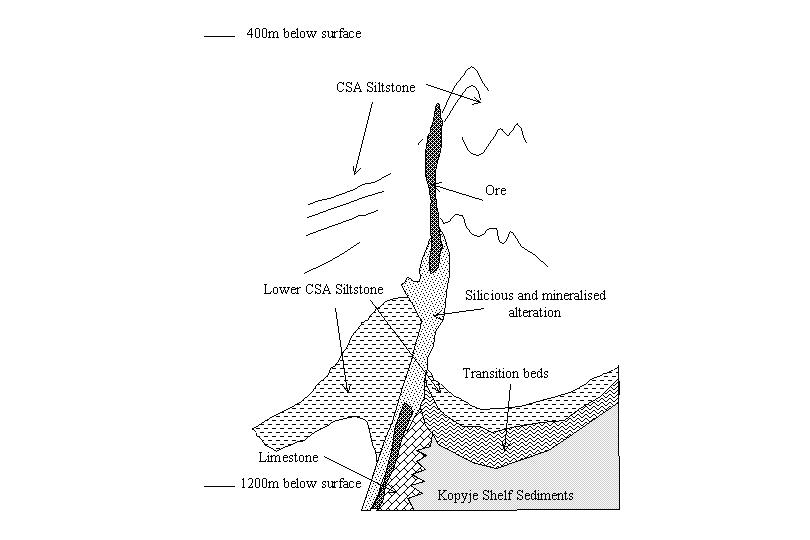

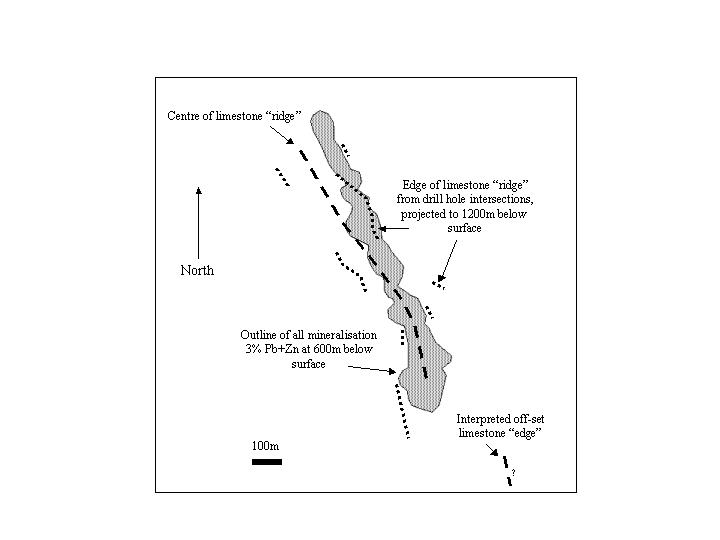

Interpretation of previous work had demonstrated the significance of the limestone found directly beneath Elura. Some of this work was carried out in an effort to create a regional exploration model based.. A cross-section and plan illustrating the distribution of the limestone is shown in figures 2 and 3. The distribution of the limestone and the vein mineralisation above it suggests that this rock type helps delineate a structure running the length of the ore body at depth. It is assumed that this structure is the channel-way for ore forming fluids entering the CSA Siltstone at Elura.

The edge of the limestone is itself mineralised and represents an exploration target, with room for at least 5 million tonnes. However because of its its location 200m below our current mine development it isnot our most urgent target. Rather, its distribution is being used to predict the most likely site for ore to be located above it.

More recently, bybuilding on earlier work, another control on mineralisation has been identified by the current mine geology team,. In logging the deeper holes from the last mine drilling programme and re-visiting some older holes it is recognised that , with the exception of the mineralisation on the edge of the limestone, ore- width mineralisation is never found beneath a particular marker in the CSA Siltstone.

A simplified version of the stratigraphy, with the ore represented, is shown in the section in figure 2. The CSA Siltstone has been divided into an upper and lower sequence. The Upper CSA Siltstone consists of repetitive turbidite sequences, containing sandstone beds ranging from 0.01m – 3m thick, grading up to silt and mudstones. The sandstone content of the sequence averages about 20-30%. Bed thicknesses are irregular.

The top of the Lower CSA Siltstone is marked by the appearance of a rhythmically banded lithology consisting of 40% sand and60% silt-mud. Both silt and sand beds rarely exceed 10cm in thickness, sand beds average less than 5cm. This unit passes down into a sequence of clean, massive sandstones (up to 3m thick) interbedded with muddy siltstones and sandstones, occasional rhythmically banded. The lower part of the sequence sometimes mimics the Upper CSA. The massive sandstone units in the Lower CSA appear to contain silica, at the expense of carbonate, in the matrix.

Massive ore is sometimes found in the top of the rhythmically banded marker unit of the Lower CSA Siltstone, but never beneath it, although silicification and spectacular sphalerite-galena-pyrite veining is common.

It is possible to put forward a number of theories to explain this observation. The higher carbonate content of the Upper CSA units may have made them more reactive and able to absorb the ore fluids. Alternatively the development of a weak but pervasive de-watering fabric in that part of the stratigraphy could have enabled fluids to disperse whereas the more brittle fracturing in the Lower CSA sandstones has confined them. The Lower CSA Siltstone overlies the Transition Beds, a shallow-water, fossiliferous mudstone, sandstone and siltstone overlying the more massive sandstones and limestone of the Kopyje Group.

Ore intersections occur at the north end of the deposit 2 where the Lower CSA is either down-faulted or dipping steeply off to the east. Prior to our current drilling it was assumed that the ore body was closed off in this region because the ore above the recent drill holes pinches out. It has now been shown that, provided the stratigraphic position is right, the pods may “re-make” below a pinched-out part of the lode. More drilling is required to outline the possible tonnage.

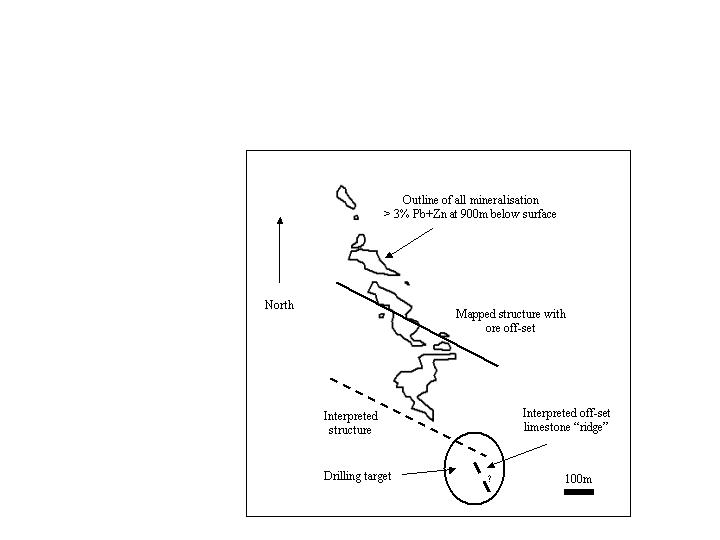

Determining the distribution of the limestone at depth has been a more difficult exercise than identifying prospective stratigraphy. Deep drill holes are expensive so data points in the limestone are few. Current interpretations suggest that it is offset to the east at the southern end of the ore body. This theory gains more weight when some of the mine geology is examined closely. The vein-like nature of the mineralisation at depth enables a clearer picture of the controlling structures beneath the deposit to emerge. The plan view of vein mineralisation at 900m below surface (figure 4) shows that the southern part of the ore appears to be offset.The orientation and style of this offset structure is very similar to one observed underground between pods 1 and 2 (also shown in figure 4). This interpretation will be used to target a hole to the south east of the mine, in addition to numerous targets on the deposit margins.

Whatever the reason for the distribution of mineralisation, it is clear that apart from the limestone target at depth the best targets in the mine are above the Lower CSA Siltstone and along the structure marked by the limestone at depth. This knowledge has governed our drill hole planning.

Figure 4. Interpreted off-set of ore position

Establishing a geological framework for our mine exploration has enabled us to determine which “gaps” in drilling should receive priority. It has also given us something to build on, so that when the results of drill holes are received we are able to determine where to direct the next campaign. Recognition of structures underground, that explain the apparent offsets observed in the deeper ore outline, and appear to be consistent with the distribution of the underlying limestone, has generated a target south of the mine.

Regional Exploration

The exploration tenements held by Pasminco in the Cobar area were seen as an asset and worth retaining, either for sale or potential resource development.

The regional programme had to be designed to work towards identifying a resource on the tenements and maintaining them in good standing without exceeding the stringent administration budget. The new operating climate gave us a good opportunity to re-evaluate our exploration programme. We had to examine the assumptions made in our exploration to date and decide on where we could get the best value for our money.

The area with the highest prospectivity requiring the greatest expenditure was the belt between Nymagee Mine and Wagga Tank. This ground was originally acquired because of a NE-SW striking discontinuity in potential field and geology data sets that bore some resemblance to a similarly oriented structure passing through Elura. However, unlike the Elura structure, this one has many points of mineralisation along it, including the Wagga Tank prospect and the May Day and Nymagee mines.

Previous drilling, outlined in table 1, had intersected significant gold and base metals south of Nymagee at the Hera and Heba prospects. This area and the Wagga Tank tenement (a joint venture with Golden Cross) were identified as two places where we needed to assess the basic assumptions from exploration results to date.

|

Hole ID |

From (m) |

To (m) |

Pb% |

Zn% |

Cu% |

Au g/t |

Ag g/t |

|

PNRC5 |

94 |

96 |

4.17 |

||||

|

PNRC10 |

12 |

20 |

3.62 |

||||

|

PNRC10 |

14 |

16 |

13.17 |

||||

|

PNDD2 |

371.4 |

380 |

11.7 |

7.3 |

1.8 |

26.6 |

48 |

|

PNDD4 |

319.25 |

320.5 |

7.03 |

3.3 |

1.3 |

||

|

PNDD4 |

323.5 |

327.75 |

2.6 |

4.2 |

3.1 |

||

|

PNDD5A |

287 |

290 |

1.8 |

2.3 |

2.15 |

||

|

PNDD6 |

435.6 |

441.8 |

5.6 |

2.9 |

2.43 |

0.74 |

31 |

|

PNDD6 |

446 |

451.4 |

5.5 |

2.7 |

0.46 |

2.33 |

Table 1. Better drilling results from EL5591

Our experience at Elura had shown us on numerous occasions how drilling can prove geological interpretation to be incorrect, with ore contacts sometimes metres away from where we’d predicted them. If this type of “error bar” applies to a mine data set, it must surely be much larger in exploration.

We had assumed the Hera mineralisation to be the best on our EL5591, south of Nymagee town and mine. In the dying days of Pasminco Exploration we had been propelled into a hastily designed drilling programme at Hera without giving much consideration to the overall geological context. With some time available to re-assess the tenement and with the results of a recently completed drill hole south of Nymagee mine showing that the mineralisation continues to the south and at depth, we realised how little we knew of the Nymagee-Heba belt. Poor outcrop and lack of previous work has led to poor evaluation of this interval.

The Cobar gold field extends 9 kms from the Great Cobar in the north to Perseverance in the south. It is possible that a similar system occurs between Nymagee and Heba(7.5km). At Hera we may be drilling the equivalent of a small “show” such as the Young Australia, ignoring a potential Peak buried elsewhere in the same system. A technique was required to determine the extent of the alteration zone to substantial depth and to identify “sweet” spots within it. Dipole-dipole IP, with inversion modelling of the data has been shown to detect the Hera mineralisation and to “see” down to 350m.Such an IP survey, covering the area between Heba and Nymagee at 150 and 250 line spacings has thus been designed and is in progress.

On the Wagga Tank EL we had believed (along with previous workers) that mineralisation occured either along shears or stratigraphic boundaries. When the data from the prospect at Siegals shaft was investigated we found that this approach had left a significant magnetic anomaly untested. Encouraged by elevated gold in RC holes in the close vicinity we drilled the magnetic anomaly and intersected pyrrhotite and chalcopyrite mineralisation carrying 1m @ 10.7ppm Au and 1.18% Cu from 79m and 1m @ 7.79ppm Au from 87m. The mineralisation is hosted by an irregularly shaped porphyry. This does not comply with the stratigraphic or shear –hosted model. Follow up work is planned to determine the shape of the porphyry, surface sampling and further shallow drilling.

The combination of geologists with a broad overview of the regional geology and those with the “reality check” of mine geology has aided the task of:

The exploration effort and results in Cobar have been maintained despite the uncertain climate. The sale process has highlighted to all the importance of exploration in securing future resources and the difficult financial situation has taught us to do more with less.

In an environment where the management recognises the necessity of exploration, outward-looking mine based exploration is a powerful strategy. Mining communities have a commitment to their own future and therefore exploration of the surrounding country. Personnel based at a mine are likely to spend more than a year in a district; they get to know the rocks and the areas of potential that may not have been looked at closely. They have the time to dig beneath the layer of first pass exploration and are committed to doing so because the future of their community depends on it.

Working our way out from the headframe with an ever-increasing knowledge of the geology shortens the odds of us being led beside the still waters of deeper ore and the green pastures of new mines.

The contribution made by Vladimir David, Rex Berthelsen , Paul Leevers and Tony Webster to the understanding of the limestone is acknowledged. Also the more recent work of Chris Grove and Trevor Ellice in recognising the Lower CSA stratigraphy. Trevor Ellice has played a big part in reconciling underground mapping with larger geological data sets to propose the (yet to be tested) southern offset. Vladimir David had significant input into the understanding of the Cobar Basin during his time with Pasminco and he continues to do so through his PhD work.By bringing his own interpretations and data into the geological model Mick Skirka has also contributed substantially in this area. In addition, he is credited with recognising the significance of the untested anomaly at Siegals prospect.

Pasminco are acknowledged for allowing me the use of company data and resources in the preparation of this paper.